Harvard Business Review: Alchemy Pay, Crypto Payment Ecosystem Pioneer

Introduction. When we discuss the future of the digital economy and real life in the next generation of the Internet, we are inevitably talking about Web 3.0. The future is unknown, but we have seen some tech companies already exploring and deepening on their tracks, such as Alchemy Pay, mentioned in this article.

We will analyze the targeted strategies and measures it has taken in the crypto payment space, taking into account the company’s sustainable long-term goals while building a rich crypto payment ecosystem that is prepared for the Web 3.0 vision with its mission of bridging fiat and crypto global economies. These measures are very informative and should be considered by other company leaders.

Once seen by mainstream zeitgeist as a fringe technology destined to die out in society, cryptocurrency is now becoming a target of investment for countless fintech industry leaders since the powerful financial future it portrays. The proliferation of crypto payment platforms and users is driving the entire ecosystem closer to mainstream adoption. As more and more large financial companies enter the crypto payment space, the competition in this field is becoming increasingly fierce. Alchemy Pay, an industry veteran with extensive industry experience and solid product technology, is performing exceptionally well in this track on all fronts.

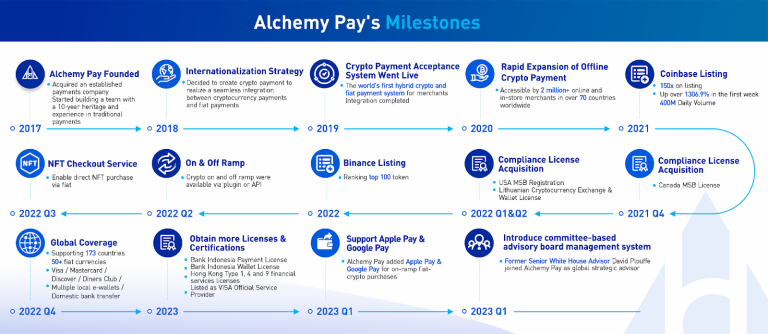

Founded in Singapore in 2017, the payment gateway that seamlessly connects cryptocurrencies and global fiat currencies for businesses, developers and users has walked a long way. It took less than 5 years to become the number one project with payment concept in the DeFi space and the leading crypto payment solution and technology provider in the Asia Pacific region. Alchemy Pay currently supports payments from 173 countries, including using Visa, Mastercard, Discover, Diners Club, Google Pay, Apple Pay, popular regional mobile wallets, and domestic bank transfers to purchase crypto, providing a fast, secure and convenient solution for over 2 million online and offline merchants with aggregated cryptocurrency and fiat payment technology. In 2021, ACH, Alchemy Pay’s token issued on Ethereum and BNB Chain, listed on Coinbase, the world’s largest compliant trading platform, continued to rise with an initial bottom of $0.001762 and rose over 13620.8% in the week after listing. How did Alchemy Pay achieve such an impressive performance in such a short period of time?

Layout in Advance to Gain Differentiated and Competitive Advantages

Shawn Shi, co-founder of Alchemy Pay, has a keen eye for capturing industry trends and assessing business potential. He saw the trend in the crypto payment field, found a head start in it, and boldly took the lead. The series of milestone decisions taken by Alchemy Pay are not only unique, but have built differentiated and competitive advantages that have kept it at the forefront of the competition. These milestone decisions are focused on three main areas:

Internationalization. Strategic placement has a direct impact on the survival and growth of a business. While competitors were still working on their local strategies and businesses, Alchemy Pay has recognized the importance of competing on an international strategy and thoughtfully chose a different set of approaches from its competitors. In its second year of establishment, Alchemy Pay incorporated an international strategy into its development plan to create a unique value.

Alchemy Pay was founded at a time when mobile payments were at their best, but the entire payment network was almost monopolized by VISA and Mastercard, which deprived traditional merchants of many options. Therefore, Alchemy Pay decided to create a payment system that would connect the entire network and develop the most adaptable digital currency solution that would seamlessly integrate crypto payments with fiat payments, providing payment services and derivative financial solutions to global merchants and users in the crypto ecosystem.

In this context, Alchemy Pay has been building a global team since its foundation and has established a advisory board management system in line with the company’s needs, implementing the corporate management philosophy of “leaving the professional to the professionals” and working together with experts worldwide from various industries to contribute to the global development of Alchemy Pay. David Plouffe, the former White House Senior Advisor and Obama’s campaign manager, has recently joined the Alchemy Pay team, serving as a committee member of management and advisory board, and as Global Strategic Advisor to support strategy, compliance and government relations.

In addition to the European and American markets, Alchemy Pay also explored and developed the payment market in South East Asia and Latin America based on market demand research, achieving the highest market share in the industry. Alchemy Pay is built as a payment gateway that seamlessly converts the assets of both parties to a transaction, regardless of whether the user is paying in fiat or crypto currency. Its product experience on the user side was simple and smooth, and its professionalism was way ahead of its Asian competitors at the time.

Compliance. While advancing its global market strategy, Alchemy Pay has recognized the importance of localized payments before its competitors. By continuously integrating localized payment methods such as e-wallets, Alchemy Pay is now able to support over 300 localized payment methods to meet the payment habits of local users and make it quicker for users to purchase crypto and Web 3.0 services using fiat currency. In the localization process, any actions involving financial and securities transactions and services are subject to local financial and securities laws and regulations. Although many countries allow cryptocurrency investment and trading, the related industries face stricter regulations.

While competitors try to avoid compliance constraints to reduce costs, Alchemy Pay believes that the only way to be sustainable is to adhere to the bottom line of compliance. With more and more countries introducing laws and regulations on data security protection and raising new requirements for the globalization of payment systems, greater data security and privacy protection is becoming a global trend. Alchemy Pay has been practicing the local compliance requirements in different countries and regions according to the specific situation, actively applying for licenses and landing business.

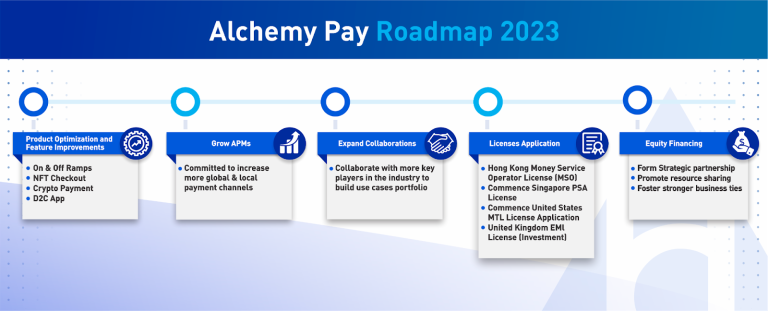

In addition to regulatory factors, the entry of companies and financial institutions has placed higher demands on cryptocurrency security and compliance, so licensed platforms have a distinct advantage in this regard. To date, less than 1% of web3 companies in the crypto payment industry have a license, but Alchemy Pay already has a large number of compliant licenses and payment channels. Currently, Alchemy Pay has obtained the 1,4,9 financial services license from the Hong Kong Securities and Futures Commission, the license from the Central Bank of Indonesia to operate remittances and fund transfers, the MSB license in the US and Canada, and Lithuanian Cryptocurrency Exchange & Wallet License, while Alchemy Pay is also applying for MSO in Hong Kong, MTL in the US, DPT in Singapore and EMI in the UK. Alchemy Pay is acutely aware of the need to expand the touchpoint to every market in terms of payments, not only to keep an eye on policy trends and changes from regulators, but also to work with local banks. This is a very slow process but is critical to creating a secure and compliant payment experience for users.

Cash flow. As Alchemy Pay moves forward with compliance and license applications in different countries, it has found that the compliance standards in Europe and the US are relatively clear, while in most other countries the laws and regulations are less clear. In such a dynamic and uncertain environment, the development of crypto business is bound to encounter some barriers, from which it is a long-term process to find a path to compliance or to establish partnerships to unify mutual understanding.

At the same time, the whole business operation and ecological construction will also take a lot of time and cost. Because fiat currencies and crypto currencies, which are the products of two financial systems, the conversion process is sometimes delayed, and a deposit of fiat and crypto funds is formed in between. To avoid users waiting, Alchemy Pay will complete the conversion by paying itself–a process that involves the act of advancing different funds. For this reason, Alchemy Pay proposes to prepare the cash flow in advance. This move not only ensures compliance operations and smooth payment systems, but also prepares itself for weathering the bear market smoothly.

Thinking Backwards, Exploring New Needs and Innovations

Co-founder Shawn Shi said the Alchemy Pay team tends to think backwards in its decision-making process, agreeing that it should not limit its thinking to the direction it would normally consider, but rather challenge inertia and look at the needs of marginal users or former non-users. In Alchemy Pay’s view, the needs of this group of people are often ignored as noise and thus become a missed opportunity for companies to advance their business. The rage for cryptocurrencies is bound to push businesses into the next phase of the internet Web 3.0 – an internet ecosystem built on blockchain, crypto wallets, non-homogenous tokens (NFT) and decentralized autonomous organizations (DAO) – and Alchemy Pay is no exception.

But unlike other companies that have entered the Web 3.0 space in full swing, Alchemy Pay felt the need to pause and think about how these technological developments might affect business and how to solve the payment challenges of people who have difficulty using conventional services, design innovative solutions for them and tap into the broader market. As a result, Alchemy Pay decided to go against the trend and go back to Web2 or Web2.5, identifying exactly those unmet needs and choosing financial institution partners that are more Web2-friendly, thus significantly broadening its reach.

Alchemy Pay believes that in order to find out where the customers are, it is necessary to focus on demographic and market trends, as the payment business is determined by user needs. Based on a large user base and user needs, Alchemy Pay has created its unique advantage “easy to use and highly adaptable”, which is compatible with all major forms of payment (POS, APP, Web, etc.) and all major wallets, and is adaptable to all major scenarios of payment solutions ( Apple Pay, Google Pay, national e-mobile wallets, etc.). This means that Alchemy Pay already meets the majority of users’ habits and further breaks the barrier between traditional payment methods and cryptocurrencies.

Alchemy Pay also meets the needs of most offline retail, e-commerce, online entertainment, bulk trading, supply chain finance, cross-border trading and other merchants, and further reduces their cost of use and improves transaction efficiency (traditional methods usually settle on the next day and charge high fees). ACH token is a value hub in its payment ecosystem, and it acts as an intermediate reconciliation token in the consensus protocol of the blockchain payment network, and can also be used to offset fees and receive various priority benefits. In the future, ACH is also expected to be the primary DAO governance pass in Alchemy Pay.

Payments, in fact, were the function of the earliest cryptocurrencies, such as Bitcoin and Litecoin, which all aimed to create a peer-to-peer, decentralized, open, transparent and irreversible payment ecology. In this ecology, users can make peer-to-peer asset transfers, which are simultaneously packaged by nodes and agreed by the whole network, which is considered a successful transaction. Due to this feature, cryptocurrencies have a theoretical potential for payments. Unlike the traditional Internet fiat payment system, which is already well established, the crypto industry and its online payments space is still in its early days due to credibility and infrastructure issues. The emergence of Alchemy Pay has built a bridge between the fiat and crypto payment shafts, on the basis of which cryptocurrencies are beginning to be accepted by traditional financial institutions. Alchemy Pay’s vision is to create a global cryptocurrency payment scenario, connecting fiat and cryptocurrencies globally, and aspires to be the next generation of payment infrastructure. The payment ecosystem and infrastructure it has built is expected to deeply integrate cryptocurrencies with traditional commerce. As the richness of the ecosystem increases and the integrity of the ecosystem matures, Alchemy Pay’s growth in the future is unlimited.

Source: Harvard Business Review

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.