Crypto prices crash – is this the big one?

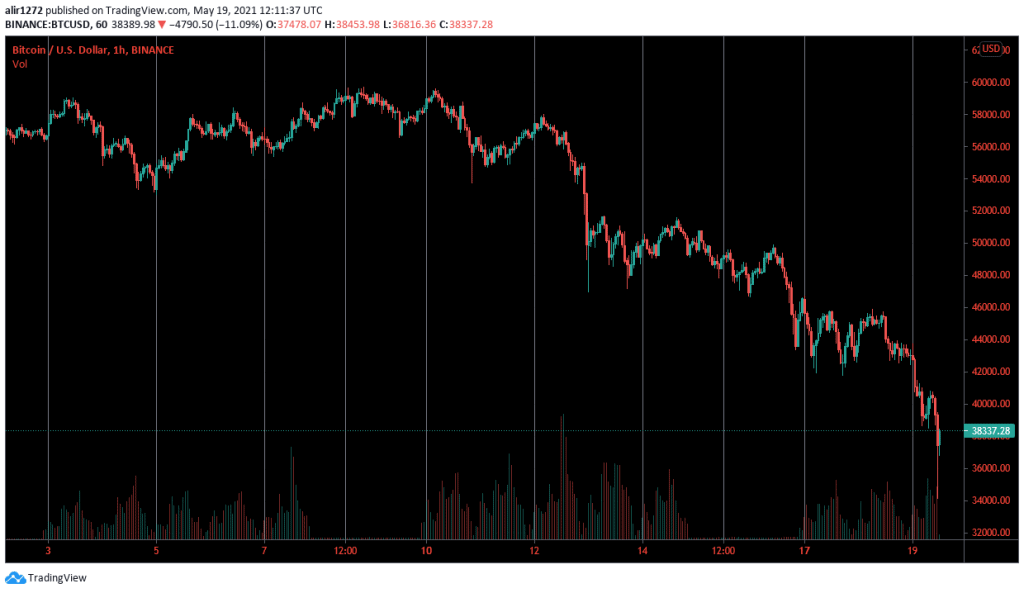

This crypto crash has so far led to $880 billion being wiped off the market in just seven days (-34%), which is leading many to ask whether this correction is going to be the big one?

Older hands will have in mind the bear market that began in 2018 – the so-called crypto winter – in which the cryptocurrency market crashed by 80% or more.

To answer that question right away — no, this is probably not ‘the big one,’ but rather a healthy correction.

However, those who think that this is the start of a new crypto winter may be justified in believing so to some extent, as we shall see.

Why do people think this is the big drop?

The history of the crypto market has been quite eventful, but overall, it has also been rather short. With only 12 years behind it, that may not be enough time or provide enough data to evince long-term patterns or to use them to predict future behaviour.

With that said though, there have been several repeating events that do seem to form a cycle, which could, in theory, continue, or until the industry stabilises enough to break it. The start or end of the pattern cannot be determined, of course, but some common events can be predicted.

For example, the crypto industry sees a massive surge that attracts new users, and the hype pushes it to new heights. After that, the fear of overextension causes people to start selling, thus causing an overshoot in selling and a bear market sets in.

The more the prices drop, the more people continue to sell, and they push crypto to its bottom.

After that, there typically comes a period of peace, or rather, stagnation. Investors are not sure whether or not they should dare to invest again, and by when they eventually muster the courage to do so, the cycle slowly starts anew.

Bitcoin 1-year gains unsustainable

With that said, Bitcoin has gone from $9k a year ago to $64k a month ago, so it really isn’t surprising that people might think that the bullish part of the cycle has ended, and the bears will be in the ascendancy going forward.

But there is also a reason to believe that this is not the start of a new bear market and that there is still more gains in store for the crypto industry before a new winter comes. This crash could simply be a long-awaited correction, especially given that BTC went up by 300% over the last six months.

Some experts believe that the current selling is being driven by newcomers fearing for the value of their investments, not understanding the market, and panic selling as a result. Institutions, on the other hand, are more likely to be HODLing, not wanting to realise losses. Some institutions may even be using this opportunity to buy as much bitcoin as they can.

With that said, no, this is likely not ‘the big one’, and an 80% drop likely won’t come for some time yet.